Steve Benjamin

612-359-2554

spb@sitinvest.com

It Pays to Start Saving Early

According to the most recent survey by the Employee Benefit Research Institute, two-thirds of Americans are “very” or “somewhat” confident that they will have enough money to live comfortably throughout their retirement years. Yet the same study found that less than half of Americans have attempted to calculate how much money they will need in retirement. Clearly, some false confidence exists in the minds of many people. And since only half of Americans have access to a company retirement plan, this may be why President Obama recently directed the Treasury Department to establish a new type of retirement account, the myRA (rhymes with IRA). The myRA program is expected to roll out later this year.

A myRA account is designed for individuals who don’t have access to a retirement plan at work and to get them saving money as early as possible. Companies that choose to participate in the myRA program will neither contribute to the accounts nor administer them but will simply forward employee contributions to the government. The contributions will earn interest, will not lose value and will be backed by the full faith and credit of the United States. Like a Roth IRA, an individual’s myRA contributions will not be tax-deductible but the growth of the account, and future withdrawals, will be tax-free. Individuals will be allowed to save a maximum of $15,000 and then may transfer their balance to a Roth IRA.

Unfortunately, the myRA may add more confusion to the alphabet soup of retirement plans already available such as 401(k), 403(b) and 457 plans as well as Traditional, Roth, SEP, SAR-SEP and SIMPLE IRA plans.

It is clear that the government would like Americans to save for retirement because, regardless of the retirement account selected, numerous tax incentives are available. With some plans, you can save on a pre-tax basis, lower your taxable income and postpone paying taxes until you withdraw your funds in retirement, when you may be in a lower tax bracket. With other plans, you can save on an after-tax (“Roth”) basis and although you won’t lower your taxable income this year, you won’t owe income taxes when you withdraw your funds in retirement. Or if you want to pay your taxes now – instead of in retirement – you can convert your pre-tax assets to “Roth” assets. Last but not least, if you contribute to a retirement account and your income is not too high, you may qualify for the Saver’s Tax Credit of up to $1,000 ($2,000 if married filing jointly) when filing your taxes.

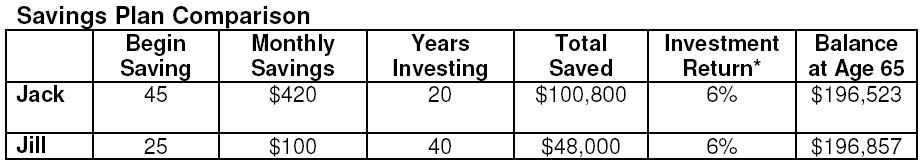

Unfortunately, many people don’t realize that the critical factor when preparing for a successful retirement is neither the type of retirement plan used nor the tax benefits available but the discipline of saving money consistently over a long period of time. In later years, the compounding of returns has a powerful effect on an account balance. The chart below shows that because Jack waited, he had to save more than twice the amount Jill did to reach the same goal.

* A 6% investment return is for illustrative purposes only. The growth of your savings will be based on the actual performance of the investments you choose. Past performance is no guarantee of future results.

Be sure to register for the September monthly meeting when Kent Johnson, Senior Vice President and portfolio manager at Sit Investment Associates, will provide an update on the equity markets and review the strategy and performance of Sit Dividend Growth Fund (SDVGX, SDVSX). If you can’t attend, please contact Steve Benjamin (612-359-2554 or spb@sitinvest.com) for a copy of Kent’s presentation.