FPA of MN Newsletter – September 2016

FPA of MN Newsletter – September 2016

Recap: Golf & Bocce Ball Outing

Here are the winners:

1st Place Team: Jason Plank, Matt Scanlon, David Auerbach, Michael Ryan

2nd Place Team: Cade Eisenzimmer, Ron Hume, Dave Anderson, Damian Winther

Straightest Drive Men: Andy Vix

Straightest Drive Women: Laura Biermann

Closest To Hole in Two Men: Dan Heiar

Closest To Hole in Two Women: Heidi Hukriede

Longest Putt Men: Mark Walsingham

Longest Putt Women: Chris Johnson

Bocce Ball Champ: Todd Swenson

Bocce Ball Runner Up: Don Galvin

Putting Contest Winner: Chris Suedbeck

Out at Tee - Lifesprk: Frank Gurtz

Out at Tee - Riverbridge: Steve Eiden

CanDo Canines 50/50: 1st - Will Hancock, 2nd - Bonnie Stanley, 3rd - Jeanna Fifer

Thank you to our Special Sponsors:

Ameriprise Financial

Charles Schwab

Denny Bennett KleinMortgage

Jensen Investment Management

Mairs & Power Funds

MarketPlace Home Mortgage

Riverbridge Partners

Stonebridge Capital Advisors

BNY Mellon

Chubb Personal Insurance

IMCA

Lifesprk

Mainstay investments

PCG Agencies, Inc.

PHH Home Loans

Scottrade Advisor Service

Alexander J. Wayne & Associates

Federated Investors

Hellmuth & Johnson

JP Morgan Asset Management

Leuthold Funds

Citizens Ind. Bank

Diamond Hill Investments

Hopkins Center of the Arts

Gruning Financial

JJ's Clubhouse

Kaplan Education

MN Vikings Football

Stages Theatre Company

Persona Custom Clothing

Prestwick

Sincere Financial Ltd

Freedom Financial

Thank you to our Platinum, Gold, Silver, and Bronze Partners!

Thank you to all that donated Raffle Prizes and Trinkets!

Thank you to all our golfers that made this a great day and fundraiser for Cando Canines - Total raised: $5,663.

Deadline for Symposium Scholarship is September 15th

Do you know a college student or career changer interested in pursuing a career in financial planning? The Career Development Committee and FPA of Minnesota are offering full scholarships to attend both days of Symposium 2016. Additionally, each scholarship recipient will be matched with a Symposium Buddy for the first day of Symposium, and their resume will be included in Symposium materials for all registrants to view. For more information, contact Megan Olson at molson@wipflihewins.com or see the application for more details.

Pro Bono Committee Staffing Financial Resources Table at 2nd Annual Power of One Fun Run

Pro Bono will be present at 2nd Annual Minnesota Army National Guard Power of One Fun Run - Suicide Awareness 5K on Sep. 11th, Ben Franklin Readiness Center - Arden Hills.

The event is for former and currently serving military personnel, military family members, and community members throughout the state of MN. The events will be used to raise awareness about the At Risk behaviors associated with Suicide, educate on protective factors and inform participants of community resources for the 5 trending issues we see in the MNNG (Employment, Mental Health, Relationship, Financial, and Substance Use) available in their region of the state.

We have been asked by Minnesota Army National Guard “to support the event with a resource table to assist our Service members across the state with accessing financial resources."

Need to Update that Headshot? Symposium Photo Shoots Are Back in 2016

Why is it important to have a professionally photographed portrait for your company’s marketing? For the same reason you might hear a prospect say “I don’t need professional financial planning help, I am doing just fine on E-trade.” The answer is that you don’t need a professional image for your online profile or webpage any more than a potential client NEEDS professional advice for their financial plan.

Your professional headshot is a core part of your marketing plan, likely the first visual contact you will have with your prospective clients. Whether on LinkedIn or on your website, the photos you use greatly impact your company’s digital image and reputation. Images are the first thing the eye is drawn to on the screen – hence it is the first impression your client or prospect has of your site/profile.

While personal photos can work (E-Trade can work too) a professional image will help you craft the image your website portrays of your company to prospects and clients – planning that image is important.

At the 2016 FPA Symposium I would like to invite you to stop by the Matte B Media Productions Photo Booth and update your business profile photo. We will be at the Symposium both days and look forward to helping you and your office update your professional online profile.

If you have questions or would like to reserve a spot please contact me at matt@mattebphoto.com.

Matt Blewett, CFP®, MSFS, RPA

Matte B Media Productions

www.mattebphoto.com

www.mnsportsnews.com

Call for Volunteers - Twin Cities Financial Planning Day

The 7th annual Twin Cities Financial Planning Day will be held on Saturday, October 29th from 10:00 am – 2:00 pm at the Wilder Center in St. Paul. The purpose of the event is to both increase the recognition and value of financial planning in the Twin Cities area and provide the public with the financial information they need at a time when many residents in our community are in urgent need of financial planning assistance.As in past years, planners will volunteer to meet one-on-one with participants to answer their financial questions. The event will also feature a series of 50-minute educational workshops as well as a resource fair where local non-profits will spread awareness of the resources and services available within the community to program attendees. The event has continued to grow from 25 participants in our first year to 225(!)a few short years later. Past participants have found volunteering for this event has been incredibly impactful and fulfilling in terms of being able to really connect with people who are in such need of the services that planners provide, not to mention a whole lot of fun. To register to volunteer for this year’s event or for more information, please visit the Financial Planning Day website. I highly encourage you to participate.

SYMPOSIUM BREAKOUT - October 10, Anne Elizabeth Denny, Beyond Mere Checked Boxes

Presentation Scheduled for Monday, 2:30-3:30 pm

Anticipated CE: 1 CFP, 1 MN insurance, 1 WI insurance, 1 NASBA/CPE, 1 CIMA, 1 CLE Stnd

Beyond Mere Checked Boxes - Empowering clients to communicate meaningful healthcare directives

Discussing your client’s mortality can be uncomfortable. Yet such conversations are essential and can reveal powerful insights about your client’s values and beliefs. Asking brave questions that explore your client’s preferences for end-of-life care will strengthen your effectiveness and role as their trusted advisor.

Inspiring—maybe even cajoling—your clients to complete written healthcare directives can be tricky. It’s tempting to simply offer a basic form. Yet, to serve your client’s interests most effectively requires more than a few checked boxes on a boilerplate form.

You might be tempted to refer this important work to an estate attorney. Don’t be too quick; you’ll miss an incredible relationship-building opportunity. Guiding your clients to proactively plan for a “good death”—however they define it—is a valuable service that will distinguish you and your practice from other professionals. Grateful clients will stay with you and refer you.

Your clients and their families can experience greater peace of mind when they prepare for—and talk about—future healthcare preferences. You can be the catalyst. Learn how when you hear speaker, author and coach Anne Elizabeth Denny present at the FPA of Minnesota Symposium.

SYMPOSIUM BREAKOUT - October 10, John Gabriel, Actively Seeking Active Share

Presentation Scheduled for Monday, 2:30-3:30 pm

Anticipated CE: 1 CFP, 1 MN insurance, 1 WI insurance, 1 NASBA/CPE, 1 CIMA, 1 CLE Stnd

Don’t Play in The Street - Active Management: Sometimes you don’t get what you pay for…

Competition from passive funds has led many active funds to cut fees. Martijn Cremers, a finance professor at the University of Notre Dame, believes that the price cuts have masked a disturbing trend. “When fund expenses have fallen, active managers have increasingly built portfolios that mirror their benchmarks–a phenomenon known as closet indexing.” In other words, expenses are lower but many managers are not trying as hard. So how do you ensure you are actually getting the active management that you are paying for?

Active managers by definition deviate from their respective benchmarks either by stock selection or by factor timing to add value for shareholders. Stock selection involves active bets on individual stocks while factor timing involves time-varying bets on broader factor portfolios (for example, overweighting a particular sector of the economy).

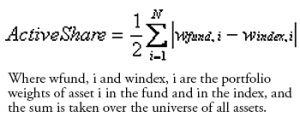

In 2009, Cremers and Petajisto published a paper titled, “How Active Is Your Fund Manager? A New Measure That Predicts Performance,” popularizing the metric of Active Share. Active Share is a measure of the differentiation of the holdings of a portfolio from the holdings of its appropriate passive benchmark index.

Sources of Active Share:

Sources of Active Share:

- Including stocks that are not in the benchmark

- Excluding stocks that are in the benchmark

- Holding benchmark stocks in different weights than the benchmark

For a mutual fund that never shorts a stock and never buys on margin, Active Share will always be between zero and 100%. In other words, the short side of the long-short portfolio never exceeds the long index position. In contrast, the Active Share of a hedge fund can significantly exceed 100% due to its leverage and net short positions in individual stocks.

Based on the Active Share calculation, Cremers and Petajisto defined four active share categories: Very Different, Moderately Different, Closet Indexer and Pure Index Fund.

| Active Share Category | Active Share % |

| Very Different from Benchmark | 80% or Greater |

| Moderately Different from Benchmark | 60%-80% |

| Closet Indexer | 20%-60% |

| Pure Index Fund | 0%-20% |

Based on Cremers and Petajisto’s sample period, 1980-2009, the Pure Index Funds grew from almost nothing in 1980 to one-fifth of mutual fund assets at the end of 2009. Closet Indexers have become even more popular, accounting for one-third of all mutual fund assets at the end of 2009.

Cremers and Petajisto discovered through their research efforts that the funds with the highest Active Share charged an average expense ratio of 1.42%. The other active fund groups exhibit slightly lower fees for lower Active Shares, but the differences were economically small for the intermediate ranges of Active Share. For example, the average expense ratio for funds with Active Share between 30% and 40% is about 1.08% per year, which is closer to the 1.23% of the group with Active Share between 60% and 70% than the 0.47% of the pure index funds. Investors are paying high expenses while investing in mutual funds that look and act similarly to an index. Clearly, investors are not getting what they believe they are paying for. Closet Indexers, who by definition stay very close to the benchmark index, can be a particularly poor choice because they almost guarantee underperformance after fees given their small allocations to active bets.

In a 2010 paper titled, “Active Share and Mutual Fund Performance,” Petajisto concludes his research by stating, “For mutual fund investors, these findings suggest that they need to pay attention to measures of active management. When selecting mutual funds, they (investors) should go with only the most active stock pickers, or combine those funds with inexpensive index funds; in other words, they should pick from the two extremes of Active Share, but not invest in any funds in the middle. The funds in the middle are providing only moderate levels of active management, which has not added enough value even to cover their fees.”

All investments are subject to risk, including the possible loss of the money you invest. Past performance does not guarantee future results. There is no guarantee that any particular asset allocation, or mix of funds, or any particular mutual fund, will meet your investment objectives or provide you with a given level of income.

SYMPOSIUM BREAKOUT - October 11, Trisha Qualy and Tom Rippberger - The Robo Advisor: Friend or Foe?

Presentation Scheduled for Tuesday, 10:55-11:45 AM.

CE: 1 CFP, 1 MN insurance, 1 WI insurance, 1 CIMA, 1 NASBA and .75 CLE Stnd

How are robo advisors a threat to the financial services industry? Trisha Qualy and Tom Rippberger run AdvisorNet Wealth Management, a Minnesota based Registered Investment Adviser, and have extensively researched robo advisors over the last two years. We help our advisor teams chose technology vendors that best fit their practices, assessing usability for staff, cost, and integration with other vendors. As the team responsible for building the operations, technology, and compliance platform at AdvisorNet Wealth Management, we have intentionally designed a flexible corporate infrastructure that can quickly adapt to industry demands. The robo advisor serves as a great case study as one of these demands.

Robo advisors first started appearing in 2008 with a focus on target-date funds and online interfaces. Since then, automated portfolio software has become much more common among advisors and consumers have become much more comfortable with sharing their financial information online. During our presentation, we will discuss current robo advisor qualities, investment selections, and the robo’s targeted client profile.

Often, other industries can be ahead of our own. Have you ever used Kayak or SkyScanner to find a great deal on plane tickets? Or do you rely on a travel agent to book flights for you? How can answers to these kinds of questions direct the future of financial services? We will explore technology examples and valuable lessons from other industries that compare to robo advisors.

After, we will look at changes within our own industry. Can small accounts actually be profitable? How are clients dictating the investor experience? And from a technology standpoint, is it easier to start from scratch? We recently led our own robo advisor initiative; with a team of management and advisors, we conducted due diligence on over 10 digital platforms and chose a vendor that was appropriate for our needs. We reviewed customer service, fees, billing, model and investment solutions, and technology platforms and are excited to share some of our findings with you.

Perhaps most importantly, we will break down robo limitation and discuss what robo advisors CAN’T do – and how humans can win. In addition, since we spend our days following technology trends, we will discuss where we see this trend going, and whether you need to fear the digital revolution

If you are considering implementing a robo advisor solution, or are just interested in learning more about this trend, join us for our presentation, The Robo Advisor: Friend or Foe?at the Minnesota FPA Symposium!

REGISTER TODAY and earn up to 14 CEs!

SYMPOSIUM BREAKOUT - October 11, Jeff Lanza – Protecting the Generations in the Information Age

Presentation Scheduled for Tuesday, 10:55-11:45 AM.

Pending CE Approval: 1 CFP, 1 MN insurance, 1 WI insurance, 1 CIMA, 1 NASBA and .75 CLE Stnd

If it doesn’t make sense, don’t click on it!

One way to stay safe from cybercrime is to watch out for things that don't make sense. For example, I received an email notifying me that I owed back taxes. The sender was listed as “Internal Revenue Service.” Already we have a situation that doesn’t make sense.

If the IRS thinks you owe them past due taxes, they won’t communicate with you about that by email. In fact, they won’t text you about it, send a Facebook status update about it or Tweet it. Think hard copy, U.S. mail.

The hackers are using the IRS name to illicit an emotional reaction that might trump common sense. If you click on the attachment in an email like this, you might download malware on your computer.

The word “malware” is derived from two terms, malicious and software. If you download malicious software on your computer, it can do such things as intercept your keystrokes when you login to your various accounts, including bank, email and more. The hackers can then use the stolen credentials to hijack those accounts.

The only thing worse than having malware on your computer is having it on your computer and being unaware. That's exactly what these programs are designed to do, hiding in the background and in many cases, they cannot be detected by antivirus programs.

To avoid this type of malware, don’t click on links or attachments in emails about subjects that don’t make sense.

It’s an easy point to forget, as many of us make are way through dozens of emails per day, often at a fast clip. So to help you remember the common sense rule, here is a short story about common sense.

The FBI had a wiretap on the phone of a mobster’s named Tony. As agents listened, a call came from Joe.

Tony: Joe, I am really glad you called.

Joe: Yeah, why?

Tony: I got a little problem. I think the FBI is tapping my phone.

Joe: What are you going to do about it?

Tony: I already got a solution. I got a new number.

Joe: OK good. Gimme the number.

Now for just a second, Tony gets some common sense.

Tony: I better not give it to you on the phone.

Joe: Right…that’s smart.

Tony: I’ll meet you for lunch and give it to you then.

Joe: I can’t meet you for lunch.

Tony: Okay, I’ll give it to you now.

Joe: Alright.

Tony: But I will give it to you backwards.

Joe: Good idea.

So Tony proceeded to give him the number in reverse order. So what did the FBI do? We got our best cryptologists on it.

Remember the Tony and Joe story and when you come across something online that doesn’t make sense. If it doesn’t, don’t proceed and keep yourself safe from possible fraud.

SEC Proposed Rule on Continuity Planning by Registered Investment Advisers

On June 28, 2016, the Securities and Exchange Commission proposed Rule 206(4)-4 under the Investment Advisers Act of 1940 that would require each SEC-registered investment adviser to adopt, implement and annually review a written business continuity and transition plan to address risks related to potential significant disruptions in, or termination of, the adviser’s business.

The proposed rule illustrates the SEC’s continued focus on cybersecurity and systems issues following its adoption in 2014 of Regulation SCI, which requires stock and options exchanges, clearing agencies, other securities market participants and certain self-regulatory organizations to establish written policies and procedures reasonably designed to ensure that their systems have levels of capacity, integrity, resiliency, availability, and security adequate to maintain their operational capability and promote the maintenance of fair and orderly markets.

Business Continuity Plans

Under the proposed rule, an investment adviser’s business continuity plan would be required to cover temporary and permanent business disruptions resulting from a number of factors including natural disasters, terrorism and cyber-attacks, other technology failures, disruptions at service providers and the departure of key personnel. It is worth noting that this proposal is the first time the SEC has imposed an explicit mandatory regulation on advisers related to cybersecurity. In its discussion of the proposed rule, the SEC noted that many advisers had already taken steps to address and mitigate the risks of business disruptions through comprehensive plans and other means. However, the SEC also found that a number of advisers have less robust planning that caused them to experience interruptions in business operations or to otherwise inconsistently maintain communications with clients and employees during periods of stress (such as during and immediately after Hurricane Sandy in 2012).

The proposed rule would require all advisers to adopt and maintain plans that are reasonably designed to address operational and other risks related to a significant disruption in the adviser’s operations. The proposed rule requires a business continuity plan to include policies and procedures designed to minimize material service disruptions and should cover: (i) maintenance of critical operations and systems as well as the protection, back-up and recovery of client data and other records; (ii) pre-arranged alternative physical locations for the adviser’s offices and its employees; (iii) plans for communicating with clients, employees, service providers and regulators; and (iv) identification and assessment of third-party services critical to the adviser’s operations.

Transition Plans

The proposed rule also requires a plan of transition that accounts for the possible winding down of the investment adviser’s business or the transition of the business to another adviser (whether under normal or unusual market conditions). An adviser’s transition plan would be required to include: (i) policies and procedures intended to safeguard and facilitate the transfer or distribution of client assets during a transition; (ii) policies and procedures to facilitate the prompt generation of any client-specific information necessary to transition each client account; (iii) information regarding the corporate governance structure of the adviser; (iv) the identification of any material financial resources available to the adviser; and (v) an assessment of the applicable law and contractual obligations governing the adviser and its clients, including pooled investment vehicles, implicated by the transition.

Although many of the proposed rule’s elements will be relevant to private equity sponsors, it is intended to cover all registered investment advisers and therefore is written very broadly. While the SEC outlined provisions that must be addressed in each adviser’s plan, it also stressed that all plans should take into account the specifics of the adviser’s business and any unique risks the adviser and its clients may face. As such, if the rule is adopted, an adviser should pay particular attention to the unique risks of its business in preparing and reviewing its business continuity and transition plan.

The comment period runs through September 6, 2016.

Review of NexGen Gathering from FPA of MN Scholarship Winner Lauren Klein

The National FPA NexGen group sponsors an annual conference each summer called “Gathering”. The 2016 conference was held in Dallas, TX and drew a max capacity 200 attendees. FPA of MN offered a new scholarship opportunity for one NexGen (36 and under) financial planner to attend the conference. This year’s winner was Lauren Klein. Read below to hear Lauren’s description of the positive impact of this conference on her business. If you are interested in attending next year’s Gathering conference stay tuned on National FPA emails and on FPA Connect; registration occurs in the winter and fills up quickly. If you are interested in attending for FREE stay tuned for FPA of MN’s scholarship opportunity which will be announced as soon as registration opens.

“NexGen Gathering was an unbelievable experience not only did I take away a lot of ideas to implement in my practice but I also got to meet a lot of AMAZING NexGen advisors. As a group we discussed everything from how to move up in your firm, office dynamics and continuing education to utilizing technology, how to market your practice and improving the client experience. The biggest take away for me was the moral support and encouragement to move forward with my ideas and create my dream practice. Since the conference I used many of the ideas we discussed and made vast improvements on my blog and client experience. Overall the gathering was exactly what I needed to recharge my passion and refocus my energy to move forward. The people and the leaders were absolutely amazing and I couldn’t be more grateful for the opportunity!"

NexGen Saints Ballpark Outing Sees a 15 - 1 Win over the Souix Falls Canaries

On August 11th, the NexGen group watched the Saint Paul Saints beat the Sioux Falls Canaries 15-1 at CHS Field. The event drew NexGen members and their families for an evening of baseball, on field entertainment and ballpark food. Stay tuned for upcoming NexGen events posted on FPA Connect and in the FPA of MN newsletter.